Year-End Planning 2021

“There is nothing sinister in so arranging one’s affairs as to keep taxes as low as possible. Everybody does so, rich or poor; and all do right, for nobody owes any public duty to pay more than the law demands: taxes are enforced exactions, not voluntary contributions…Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.”

~Judge Learned Hand

Helping clients reduce their tax burdens is an essential element of our job as advisers. At the end of each year, we communicate proactively with tax preparers and in many cases with attorneys, looking for ways to legally and sensibly save taxes. When tax laws change, as they do with depressing frequency, we adjust our strategies to maximize tax savings.

This is an especially tough year for year-end planning. In mid-November, we still lack clarity about how the tax law may change as a result of President Biden’s ambitious Build Back Better legislation, which combines big spending initiatives with multiple tax increases on higher-income individuals and companies.

Lacking clarity on the rules, and running out of calendar to make changes, here are some of the strategies we’re helping clients implement as appropriate.

Income shifting: When tax laws are static, it’s usually best to push income into next year and bring deductions forward into this year. But if 2022 income will be taxed at higher rates, it might be better to realize income in 2021, but push deductions into next year.

Deduction bunching: The 2017 tax reform established much higher standard deductions. In 2021, they are $12,550 for individuals and $25,100 for couples filing jointly. Unless your itemized deductions exceed these amounts, you’ll get no tax benefit from itemizing. But if you bunch multiple years of deductions into a single year, you can save on taxes. Here are some examples.

Charitable clumping: You might be able to itemize and reduce taxes if you clump several years’ worth of charitable donations into one year. Let’s say you normally donate $25,000 per year to charity, and have no other deductions. If instead you give $50,000 to charity in one year, and zero the next, you’d get an additional $24,000 of tax deduction above the standard–$50,000 itemized deductions in year one, and $25,100 standard deduction in year two.

Other deductible expenses. If you anticipate deductible expenses in the coming years, you may be able to accelerate them by making payments in this tax year. This category may include medical costs and certain interest expenses.

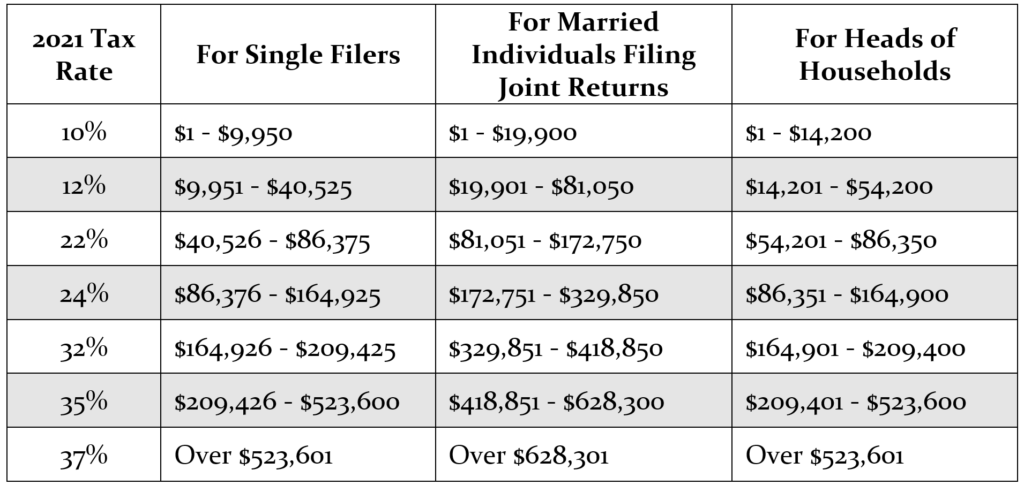

Income flattening. The US has a progressive income tax system, in which higher income is taxed at higher rates. But higher tax brackets aren’t retroactive. A married couple filing jointly with income of $81,049 would pay a marginal tax rate of 12% and an average income tax rate of 11.51%. Their next dollar of income ($81,050) is taxed at $0.12. But the following dollar ($81,051) would be taxed at $0.22. Only that single dollar would be taxed at the higher rate. This is why the statement, “I don’t want to earn more money because it would put me into a higher tax bracket” reflects a misunderstanding of how taxes work.

You almost never want to have no taxable income and pay zero tax. Instead, take full advantage of at least the 10% and 12% brackets each year. Some strategies to fill up the low brackets in a low income year include:

Roth IRA contributions: If you’re experiencing a lower tax year, you might choose to make a non-deductible Roth IRA contribution instead of a deductible Traditional IRA contribution. Roths don’t provide a current tax deduction, but after-tax contributions to a Roth grow and distribute free of taxes.

Traditional-to-Roth conversions: If you have a Traditional IRA, you can convert some or all of the dollars in that IRA to a Roth IRA with superior tax treatment on withdrawal. All dollars converted will be taxable income in the current year. When should you consider this move? Converting Traditional IRA dollars to Roths at a tax rate of 10% or 12% is a no-brainer, while paying 22% or more at today’s elevated market prices is difficult to justify. A caveat—the “backdoor Roth” strategy that allows some higher-income earners to indirectly fund a Roth IRA without tax effect may be eliminated by pending legislation.

Elective IRA distributions after 59½: For owners of large tax-deferred accounts, a relatively low tax year might present an opportunity to reduce the impact of your future Required Minimum Distributions (RMDs), which begin at age 72 and are taxed as ordinary income. If you’re in a lower marginal bracket, you might consider taking distributions from 401(k)s and IRAs before they’re required to help flatten the long-term tax burden of significant RMDs. Distributions prior to age 59½ may result in a 10% penalty.

Those of us in higher income brackets have the opposite problem. We’re trying to reduce income taxed at federal rates as high as 37%, not fill up those 10% and 12% tax brackets. For us, here are some strategies to reduce taxable income:

Pre-tax retirement savings plans: Maximize pre-tax contributions to retirement plans, such as 401(k)s, money-purchase or profit-sharing plans, and IRAs. This achieves two aims: it reduces current-year taxable income and provides tax-deferred growth

Health Savings Accounts (HSAs): Always maximize your HSA contributions if you have one. (Most of us do not.) HSAs are actually better than 401(k)s, since they are likewise tax-deductible up front and grow tax deferred, with the added advantage of tax-free distributions for qualified medical expenses.

QCDs: Use a Qualified Charitable Distribution (QCD) to reduce the Required Minimum Distribution from your IRA after age 72. Each taxpayer can offset up to $100,000 of RMDs by electing QCDs to charity.

Successful families often have large portfolios in taxable accounts. Tax rates on capital gains might go sharply higher for a few wealthy taxpayers, and it’s even possible unrealized gains might be taxed. Some options:

Manage capital gains: Where practical, avoid short-term capital gains, which are taxed at ordinary income rates. Long-term gains are more complex, but offer the benefit of being taxed at the lower, capital gains rate (15% – 20%).

Harvesting capital gains. There’s been much discussion about potential increases in the capital gains tax for higher income taxpayers. If you have appreciated assets, and you expect to sell them in the next few years and realize taxable gains, and you expect higher long-term capital gains rates to increase sharply in the near future, you may want to realize gains and step up your cost basis in this year’s lower tax environment.

Deducting capital losses. If your realized capital losses exceed your realized capital gains, offset ordinary income with up to $3,000 in capital losses in any given year. It may be possible to carry over capital losses that exceed the $3,000 limit to offset capital gains in future years.

There’s a final category of tax-saving strategies, which is moving assets to lower-bracket individuals, usually younger family members.

Annual exclusion gifting. Make tax-free annual exclusion gifts of up to $15,000 as an individual, or $30,000 as a married couple, and they won’t count toward the lifetime exemption from federal estate and gift tax. These are per-person limits, so gifts can be made to as many people as you choose.

The lifetime gifting exemption. For 2021, the amount exempt from federal gift and estate tax is $11.7 million per person. Right now, each of us can gift that much in total without paying any gift tax. (We’ll need to file an informational tax form.) We’ve been worried that pending legislation might reduce that amount by half starting in 2022. That fear has receded somewhat, but we already know for sure this exclusion will fall by half on January 1, 2026. If your family’s net worth is over $12 million, you definitely want to consider lifetime gifts.

Conclusion: Thinking about taxes can make your head explode. Whether you choose to defer income, or to accelerate it, will depend on your individual circumstance.

Our philosophy is to know how the rules are changing, pay all taxes due, reduce taxes owed, and never let the tax tail wag the financial dog. This year, with new tax legislation on the horizon and uncertain economic conditions, it’s even more important to examine your strategies closely and prepare for what the future may hold.

By James S. Hemphill, CFP®, CIMA®, CPWA®/ Managing Director & Chief Investment Strategist

Jim has been a CERTIFIED FINANCIAL PLANNER™ professional since 1982. Jim specializes in complex wealth transfer and retirement transition strategies and coordinates TGS Financial’s investment research initiatives.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.