The Real Estate Illusion

Just yesterday I met with a client who is also a good friend. She told me that another friend had just sold her house, in preparation for a move south to be closer to family. The sales price stunned me. It was more, for a semi-detached house in a small nearby city, than my wife and I paid for our much larger, brand-new house back in 1995. Clearly, the local real estate market has made a more-than-complete recovery from the dark days of 2008-2009.

You can’t listen to the commercials on talk radio, or turn on any of the multiple real estate-themed cable TV stations, without running into another presentation about “flipping” real estate. Just as in the mid-2000s, it seems like ownership of residential real estate is an easy way to make big money.

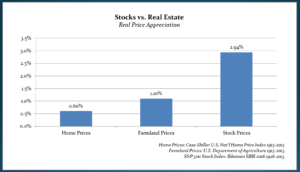

Certainly, the recent real estate cycle has been positive. But long term, U. S. residential real estate is an under-performing asset class. Consider the following data from economist Robert Shiller:

Of course, the chart does not include the economic value of the implied rent from living in your home, or the value of the crops produced on a farm. But it also doesn’t include the dividends on common stocks, and it ignores the substantial ongoing costs of maintenance on your home.

Based on this data, houses are lousy investments. We always tell our clients that a house is an expense, much more than it is an asset.

A house is an expense, much more than it is an asset.

How about other real estate? Isn’t investing in rental property a great way to make money?

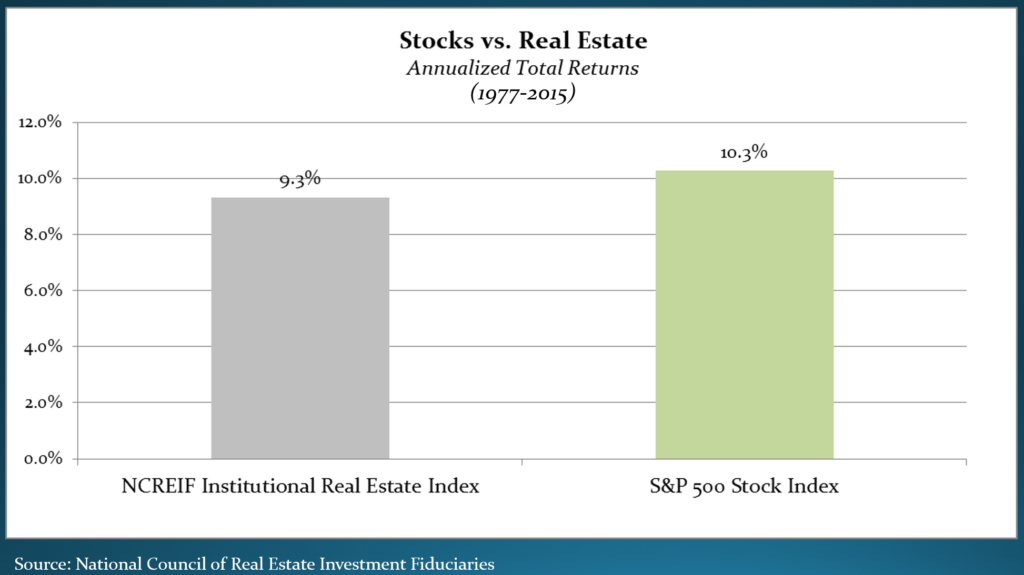

This is a more complicated question. If we consider the returns on the very highest-quality real estate properties, the sort of big-city trophy properties owned by insurance companies, large endowments, and huge pension plans, the long-term returns have been positive:

Note that the returns on institutional real estate are slightly lower than for stocks. More important, keep in mind that these are the very finest properties in the United States, managed by the most expert professional real estate investors. In other words, not at all similar to owning a duplex, or a small strip shopping center, or a rental house at the shore, or the building where your office is located. Note something else about institutional-quality real estate. Historically, the bulk of the economic return comes in the form of current cash flow, and not in the form of appreciation. So if you own an investment property, and it does not produce current cash flow, it is really a speculation on future irrational price appreciation. (The current pricing is already irrationally high, or you would be getting a cash return. This scenario is especially common with vacation properties in over-priced markets.)

I know several expert, experienced, highly-successful real estate investors. They have earned positive long term returns from carefully-chosen, competently-managed properties. I know a larger number of individuals who have lost money owning real estate, usually because they thought that real estate was an automatically risk-free high-return investment. And finally, I know an even larger number of individuals, my wife and I included, who have spent large cash flows over decades owning their own homes, receiving unique psychic and significant practical benefits, without having any way to accurately quantify the precise economic results.

Buy and live in the house you want, expecting that it will reduce your total lifetime wealth, not enhance it. Don’t confuse your home with a profitable-wealth enhancing investment.

By James S. Hemphill, CFP®, CIMA®, CPWA®/ Managing Director & Chief Investment Strategist

Jim has been a CERTIFIED FINANCIAL PLANNER™ professional since 1982. Jim specializes in complex wealth transfer and retirement transition strategies and coordinates TGS Financial’s investment research initiatives.

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by TGS Financial Advisors), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from TGS Financial Advisors. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. TGS Financial Advisors is neither a law firm nor a certified public accounting firm and no portion of this article’s content should be construed as legal or accounting advice. A copy of the TGS Financial Advisors’ current written disclosure statement discussing our advisory services and fees is available upon request.